Three entrepreneurs, three digital businesses set to make waves in the regional watch, sneaker and fashion e-tail scene.

Three entrepreneurs, three digital businesses set to make waves in the regional watch, sneaker and fashion e-tail scene. They share more about the stories behind their companies, connecting buyers to sellers, and the growing importance of the secondary market and the digital marketplace.

CO-FOUNDER AND CEO, WATCHBOX

Last November, The Great Room co-working space at Ngee Ann City became home to a treasure trove of timepieces, including difficult-to-obtain watches such as sporty steel models by Patek Philippe and Rolex. That’s when the Watchbox Lounge was launched, in tandem with the Singapore debut of Watchbox, a global e-commerce platform that sells preowned luxury timepieces.

The co-founders – Danny Govberg, president/ CEO of Govberg Jewelers in the US; Tay Liam Wee, former owner of Sincere Fine Watch; and investor-entrepreneur Justin Reis, who was born in Australia but grew up mainly in Singapore – were in town for the opening. With six locations worldwide, Watchbox owns an inventory with a market value of more than US$80 million (S$107.8 million). Here, Reis shares the company’s plans to become the leading name in the US$16 billion preowned-watch industry.

WHY AN E-TAILER NEEDS A PHYSICAL SHOWROOM: “Singapore is the sixth-largest Swiss watch market in the world. But in the US and some parts of Europe, e-commerce is a lot more developed. In Asia and some other parts of the world, customers are hesitant about putting a $20,000 watch in a FedEx envelope and sending it off. Part of our online-to-offline strategy is to have a physical point of sale, where people can come in and understand what our business is about.”

WATCHBOX’S RELATIONSHIP WITH WATCH BRANDS: “We built this business to be a friend of the brands; never to be disruptive towards what they were set up to do. Today, once a customer has bought a brand’s watch through an authorised dealer, the relationship more or less stops there. We look to uphold the integrity of that brand over the next phase of the watch’s journey, as the customer continues collecting other watches. We’ve been approached by some watch brands to work with them. They recognise that customers don’t necessarily have just one watch from one brand. They need a platform that allows the transfer of products from different brands.”

SAME BUT DIFFERENT: “We’re in six locations worldwide now, with our launch in Singapore and the Middle East [with Middle Eastern luxury watch retailer Seddiqi & Sons]. With Seddiqi, we’ve opened a 1,700-sqft Watchbox physical location in Dubai where people can transact – or they can go to any of the Seddiqi multi-brand stores and trade in their watch for a new watch, or another premium preowned piece. We keep our preowned products separate from new products, although customers tell us they can’t really tell the difference.”

BRAND TO WATCH: “Everyone knows the top few brands and model families that sell or trade well better on the secondary market. But recently, we’ve been spending a lot of time investing in independent brands, such as F.P. Journe. My favourite from the brand is the Chronometre a Resonance; it’s a beautiful timepiece. The brand’s watches are also quite rare because they produce fewer than 1,000 pieces each year.”

FOUNDER, OX STREET

For peripatetic 34-year-old Amsterdam native Gijs Verjeike, it was a stint in Myanmar that first opened his eyes to the burgeoning sneaker scene in South-east Asia. After working in private equity in Amsterdam for over two years, the Dutchman joined e-commerce investor Rocket Internet in 2015, moving to Bangladesh and subsequently, Myanmar, where he launched online job portals. He recalls: “In Myanmar, many of the young people working for us were in their first jobs. I noticed that when they got their salary for the first time, the first thing they would buy was a smartphone – and the second thing was sneakers. I thought, ‘This is really going to be something in South-east Asia.’”

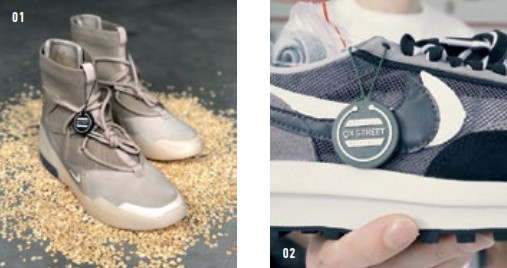

Verjeike moved to Singapore last July, and in October he launched Ox Street, a premium sneaker resale digital marketplace for the South-east Asian market. Sneaker resellers buy these shoes, especially limited editions, from retailers or other sources, with the intention of selling them again. Ox Street connects sneaker resellers and buyers within the region, with the average price of a purchase on the site being $500. Says Verjeike: “We regularly see sneakers in the four-digit price range. The sneaker resale industry is on track to being worth US$6 billion. The biggest misconception is that it’s just a small niche for hardcore sneakerheads.”

SHOE SOURCES: hoe sources: “We sell deadstock (unworn) sneakers and we’re a marketplace; we don’t hold stock. We work with local sellers, who usually keep the stock in their own homes. They have different sources – sometimes they get lucky and manage to buy popular sneakers at retail, sometimes they buy them while on holiday, and some buy their stocks on the resale market.”

MARKET FORCES: “Our prices are set by the market. Our sellers set their prices, and buyers have the choice of buying a product for that price, or making an offer. If they do the latter, we send the sellers a message immediately telling them about the offer – and asking them if they accept it or not. We try to facilitate price-setting in a transparent way.”

FANCY FOOTWEAR: “If there’s one sneaker that epitomises the Asian sneaker scene now, I’d say it’s the Adidas Yeezy 350. But the priciest sneakers are models such as collaborations with (American rapper) Travis Scott, Air Jordans and certain OffWhite models. We have loyal customers who spend between $2,500 and $3,000 a month on Ox Street.”

"Bob Chua, founder of Blinq."

FOUNDER, BLINQ

For Malaysian serial tech entrepreneur Bob Chua, starting a fashion e-commerce venture was the logical next step after three exits in the data industry. In January 2018, the 45-yearold Malaysian and his team launched Blinq, a Singapore-based luxury fashion digital marketplace focused on South-east Asia. Last March, the company raised US$2 million in funding, and is gearing up for another round.

Aside from partnering fashion retail companies such as Yoox Net-a-Porter to carry major luxury brands ranging from Givenchy to Gucci, Blinq also stocks smaller Asian designers under a dedicated category called Asean Houz.

What really sets the platform apart, however, is its proprietary augmented-reality technology that allows users to virtually try on clothes on a photograph of themselves. According to Chua, this virtual dressing-room feature has an accuracy of 98 per cent, and has helped Blinq to maintain a product return rate of zero since its launch – an astonishing figure, considering that the return rate for online retailers is typically reported to be at least 20 per cent.

IN THE LOOKING GLASS: “Three megatrends set me on this path of Blinq. Firstly, South-east Asia has a strong, growing affluent population. Secondly, luxury retail in this part of the world is worth about US$500 billion right now, and it’s growing at 12 per cent. Thirdly, there’s e-commerce. By 2022, e-commerce is going to represent about 60 per cent of retail worldwide. In South-east Asia, e-commerce is still around eight per cent of retail. The potential to move online is huge.”

REGIONAL FOCUS: “Our business model is mainly based on dropshipping – when somebody buys a retailer’s product through Blinq, they ship it out of their own facility, using our packaging and protocols. We believe that marketplaces are the future of retail; Amazon, Alibaba, Farfetch – they’re all marketplaces. That’s where you can enjoy economies of scale and offer consumers more options from different brands.”

INDEPENDENTS’ DAY: “We have five main product categories. To help smaller, medium-sized Asian designers and retailers, we created a category called Asean Houz. It’s a way to help small luxury brands that people don’t necessarily know, and that don’t have the funds, marketing prowess and tech know-how to create an e-commerce platform and gain awareness.”

01 STREET / STYLE

The latest footwear offerings by our favourite Parisian luxury house blend streetwear influences with its signature sophistication.

Much has been said about the inexorable rise of streetwear and its influence on luxury fashion, for better or worse. Many designer brands seem to have somewhat lost the plot, especially when it comes to footwear. Some of their sneakers, for instance, have swelled to truck-like proportions, with enough clashing colours to make Warhol’s works seem monochromatic.

Showing how it should be done is Hermes, which has been masterfully mixing ease and elegance way before anyone was talking about the casualisation of once-formal dress codes. Its Spring/Summer 2020 collection tastefully taps into the streetwear zeitgeist: A pair of low-cut sneakers is made mostly from the technical-knit, a sock-like material typically associated with fashionable sports shoes, and then elevated with buckled calfskin quarters (the sections of a shoe where shoelaces are threaded).

02 THE NAME IS BOND

03 LESS IS MORE

04 TRUE METAL

Typically worn for short periods of time and updated in a multitude of ways each season, sunglasses are an easy, low-commitment way to refresh your look. One big trend this season is the use of metal in unexpected ways. We’re intrigued by Dolce & Gabbana’s Fatto a Mano (Italian for handmade) foldable shades, which feature a metal bridge hinge with a pattern resembling grosgrain fabric (pictured). Also notable are the metal accents that heighten the drama of Burberry’s triangular lenses with a series of spaces and voids.

TEXT LYNETTE KOH