On-demand charter jets without the heavy upkeep of ownernership are the growing choice of ultra high net-worth individuals.

On-demand charter jets without the heavy upkeep of ownernership are the growing choice of ultra high net-worth individuals.

Flying the skies on private aircraft instead of commercial airlines is gaining traction among business executives.

But instead of owning jets, which can cost up to US$60 million (S$83 million) each and more than US$4 million a year to upkeep, ultra-high networth individuals, or UHNWI, are now gravitating towards private charter.

It’s a global trend. A June report by aviation specialists Argus International showed that the charter jet business grew 11.5 per cent year-on-year, while fractional or part ownership of executive aircraft fell 21 per cent.

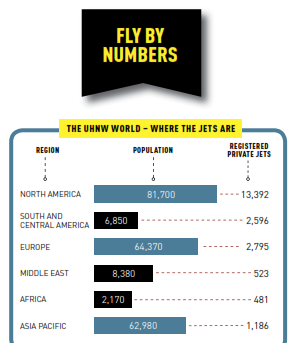

It is the same in Singapore. In Asia Pacifi c, the country ranks second with a ratio of 30 charter jets based here for its 28 billionaires. Australia leads with 57:27.

Competition is intense for the UHNWI dollar and among the leading charterers are VistaJet, Xojet, Blue Star Jets, Luxury Aircraft Solutions and One Sky Jets. VistaJet does not operate from any permanent location and instead spreads its 70 Bombardier aircraft across all continents to be near their customers.

Says Leona Qi, the company’s president of Asia, “VistaJet aircraft do not have a home base, meaning we can be in locations when and where our customers want our jets. For operators with dedicated home bases, any flights outside of their zones are outsourced, making in-fl ight experiences inconsistent, depending on what aircraft customers are given.”

Riding on the trend, London-based Fly Victor created an on-demand free app that connects executives to 3,000 charter companies worldwide including VistaJet. Like the Grab ride-hailing platform, travellers just key in details on where and when they want to fly and can choose from 7,000 jets. They are given comparative costs and details on aircraft and are then set for take off.

Dan Northover, Victor’s chief marketing officer, says the company offers a mix of “high tech and hightouch customer service” through its website, app and 24-7 phone services.

“Digital transformation is the major trend impacting private aviation,” he adds. “Technological advances will continue to bring increased transparency and simplicity to the business aviation sector, which will open the market to a whole new audience.”

Following the model of such services, Fly Victor has recently launched Alto, a frequent-flyer programme where customers can use points to off set the pricing of future flights. The programme is billed as a world first for private jet charter.

So what’s the price range for private aviation? Hourly rates on a Vistajet aircraft that can seat as many as 11 are from US$12,000 to US$17,000 – arguably as cost effective as first class seats on commercial flights. And now, with the introduction of a rewards system not unlike that of commercial airlines, customers will have more incentive to fly private.